Corp – FAQ

When incorporating your business structure, you’ll be faced with an important decision—whether to set up your business as a C-Corp vs. S-Corp. This choice has big implications for how much you’ll pay in taxes, your ability to raise money, and the ease with which you can expand your business. It can be hard to understand the differences between C-corporations vs. S-corporations. Fortunately, the differences come down to three main areas: formation, taxation, and ownership. The last two are the most important. In most other aspects, S-corps and C-corps are similar.

Formation: The most basic difference between S-corps and C-corps is formation. The C-corp is the default type of corporation. When you file articles of incorporation with your secretary of state, your company will become a standard C-Corp. S-Corp is not a legal business entity per se but rather an entity strictly for taxation purposes which must be elected. A C-Corp or LLC can elect to be taxed as S-Corp by electing such status with the IRS. After filing the form, you will become an S-Corp for federal tax purposes but for legal purposes your business is still recognized as originally formed, a C-Corp or LLC. You might have to file additional papers at the state level to be treated as S-corp for state taxes.

Taxation: Taxation is the main difference when comparing C-corps vs. S-corps. Many business owners elect S-Corp classification to save on taxes.

C-corps are subject to “double taxation.” First, the C-corp is taxed at the corporate level when the company file a corporate income tax return. A C-corp can then be taxed again, on the owners’ personal income tax returns, if corporate income is distributed to the corporation’s shareholders as dividends.

The only ways for C-Corp to avoid double taxation is:

- The company don’t make any profits (i.e. operate at a loss) or

- if the company profits are reinvested back into the business instead of providing a dividend to its shareholders. Wages and salary, including the owner’s salary, are generally considered deductible expenses, so no taxes are levied under this concept. However, the IRS can “re-class” excessive salaries as a taxable dividend.

Under a S-Corp, shareholders/owners report their share of the business’ income and losses on their personal tax return. This is called pass-through taxation. As a shareholder of a S-corp, your business’s income ‘flow-through” and is taxed on your personal income when filling Form 1120S.

What the New Tax Law Means for C-corps for Tax year 2018

- The law provides for a large tax cut for C-corps, but double taxation as a C-corp is inevitable. The company will first be taxed at the 21% corporate tax rate for ALL income level, and dividends are subject to taxes on the personal income tax return.

- However, if your business is in growth stage and you’re planning to reinvest most profits back into the business, the C-corp tax cut could work in your favor only if dividends are not distributed to the shareholders/owners.

What the New Tax Law Means for S-corps for Tax year 2018.

- The 20% deduction for S-corps and other pass-through entities lets you save money. Businesses with less than $157,500 in annual income (for single filers) or $315,000 (for married joint filers) can take full advantage of the deduction.

- There are limits to the deduction based on the type of business, the amount of income, and the amount of wages you pay to employees. Professional service businesses like lawyers and doctor’s offices have the most limitations.

Launch your business today from $49 + State Fee.

FREE 1st Year

Registered Agent

SEE DETAILED PRICING

Common questions for LLC.

View all LLC FAQ

Ownership: C-corporations have no restrictions on ownership. Unlimited number of shareholders, as well as different classes of shareholders are the main perk to form a C-Corp. Venture capital firms and investors prefer to hold preferred stock in a corporation, which is only an option for C-corps, severely limiting capital raising as an S-corp. S-corporations are limited to one class of stock, meaning that there’s only one kind of shareholder. There’s no hierarchy or difference between shareholders of the business,

S-corporations can have only up to one hundred shareholders. Shareholders of an S-Corp must be United States citizens or legal resident aliens, whereas C-corps doesn’t have this restriction and are open to foreign investors.

If you plan to sell your business down the line or spin off a subsidiary, a C-corp could be a better choice. An S-corp can’t be owned by a C-corp, other S-corps, LLCs, general partnerships, or most trusts. Other corporations, LLCs, or trusts can own c-corporations.

What are the main differences between an S Corp, C Corp, LLC and a sole proprietorship?

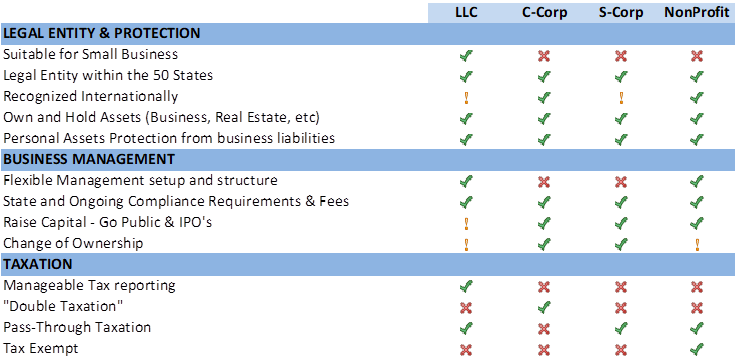

Below a summary table of main differences side by side between business entities.

| Limited Liability Company (LLC) | C Corp | S Corp | |

| Formation Requirements, Costs | Must file with state, state specific filing fee required | Must file with state, state specific filing fee required | Must file with state, state specific filing fee required |

| Personal Liability | Members are not typically held liable | Shareholders are not typically held liable | Shareholders are not typically held liable |

| Administrative Requirements | Relatively few requirements | Election of board of directors/officers, annual meetings, and annual report filing requirements | Election of board of directors/officers, annual meetings, and annual report filing requirements |

| Management | Members can set up structure as they choose | Shareholders elect directors who manage business activities | Shareholders elect directors who manage business activities |

| Term | Perpetual, unless state requires fixed amount of time | Perpetual: can extend past death or withdrawal of shareholders | Perpetual: can extend past death or withdrawal of shareholders |

| Taxation | No tax at the entity level. Income passed through to members | Taxed at corporate rate and possible double taxation: Dividends are taxed at the individual level if distributed to shareholders | No tax at the entity level. Income passed through to the shareholders. |

| Double Taxation | No | Yes, taxed at corporate level and then again if distributed to shareholders in the form of dividends | No |

| Self Employment Tax | Salary subject to self employment tax | Salary subject to self employment tax | Salary subject to self employment tax, but shareholder distributions are not subject to employment tax |

| Pass Through Tax Treatment | Yes | No | Yes |

| Transferability of Interest | Possibly, depending on restrictions outlined in the operating agreement | Shares of stock are easily transferred | Yes, but must observe IRS regulations on who can own stock |

| Capital Raising | May sell interests, but subject to operating agreement (Securities laws may also apply) | Shares of stock are sold to raise capital (Securities laws apply). | Shares of stock are sold to raise capital. Limitations prevent S corp stock ownership by corporations or foreigners |

| Ease of Operation | Easy, some states may require more than others | Must have annual meetings, Board of Directors meetings, corporate minutes, and stockholder meetings | Must have annual meetings, Board of Directors meetings, corporate minutes, and stockholder meetings |

Deciding entrepreneurship and starting a new business is just the first step. Choosing the right type of entity structure for your business is vital. Known as “business entity type”, your choice determines your organizational structure, tax classification, personal liability, federal and state regulation, compliance and more. There are key differences, advantages and disadvantages between them. FastInc USA, helps you decide the business type that is right for you with its advantages and disadvantages.

Can I incorporate an LLC and elect S-Corp status ?

Yes, and it might be considered the best of both worlds. Establishing your business as an LLC and then electing S corporation status for tax purposes has long-term planning advantages.

Both organizational forms share the characteristic of “passing-through” their income to the owner/shareholder(s). Both also provide their owner(s) limited liability protection but each has some distinguishing features, too.

You, as a new business owner, might want to consider the differences as you choose the form for your enterprise:

- An LLC is easer to operate and administrate than an S corporation.

- An LLC is more flexible in allocating percentage of profits and losses among owners/shareholders than an S corporation.

- An S corporation has more flexibility in paying its earnings to owners as either earned income in the form of salaries and wages or as distributions than a typical LLC

- An S corporation has significant tax planning advantage than LLC, being the key difference reducing the amount paid in self-employment taxes.

Combining the benefits of the LLC and S-Corporation status would offer these benefits:

- From a legal perspective, your enterprise will be an LLC rather than a corporation. Hence, you will have the benefit of ease of administration-fewer filings, fewer forms, fewer start-up costs, fewer formal meetings and record keeping requirements

- From a tax perception, your enterprise will be treated as an S corporation. You’ll still have the pass-through of income, avoiding double taxation, same as if your LLC was treated as a proprietorship or partnership.

- Without the administrative hassles of actually being a corporation, you will still benefit from the IRS treating your business as one. To the IRS, your business will exist separate and independent from you–its owner. Therefore, the business entity can pay wages and salaries to you or to other owners. This amount will be subject to FICA tax and other withholding requirements. But then, it can distribute the remaining net earnings to you and the other owners as passive dividend income, not subject to SECA tax.

- Being treated as an S corporation may provide opportunities for tax planning to minimize the overall tax liability for your business and you. It may allow your business to take advantage of better tax treatment for certain fringe benefits, too.

Clearly, you need to carefully consider the pros and cons of different forms of business organization. Be sure to consider how all the aspects-legal, tax and operational–of each organizational form will impact your unique business enterprise. Seeking professional advice from a CPA or tax attorney is always a wise practice when making choices like this that can affect your business for many years to come.

For further tax planning get a free consultation.

Still have questions ?

Incorporate Now and enjoy our services

© 2019 Fast Inc. Usa All Rights Reserved

FAST INC LEGAL DISCLAIMER

PRIVACY POLICY

CANCELLATION/REFUND POLICY

Follow Us: