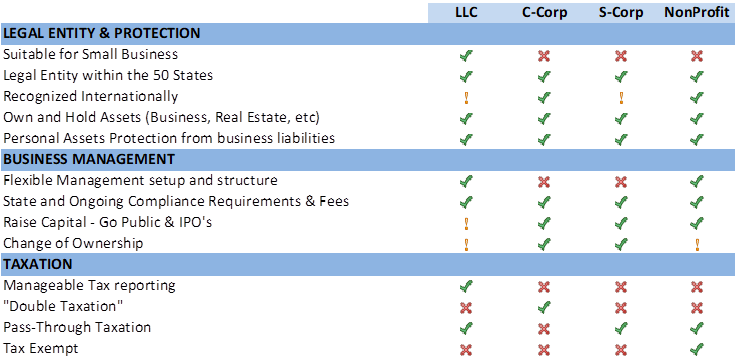

Entity Type Comparison

As you plan starting up your own business, one of the first decisions you need to make is the formal business structure you will assume. Which structure you choose depends on your industry, growth goals, and how many people you plan to involve in your company. It is important to have a full understanding of the business structure you take – but at the same time, I caution you to avoid paralysis through analysis. Make an informed decision and get back to focusing on starting and nurturing the growth of your business.

The following are six types of business structures you could choose from.

Sole Proprietorship

This is the easiest type of business to start. There are no incorporation forms to file or fees to pay with the government. You pick your business name, and get to work. With a sole proprietorship, you avoid double taxation that occurs in corporations as every dollar you earn hits your personal income tax. You pay no corporate income tax.

Launch your business today from $49 + State Fee.

FREE 1st Year

Registered Agent

SEE DETAILED PRICING

Common questions for LLC.

View all LLC FAQ

Because of the ease of starting this type of business, there is a larger amount of risk involved due to the lack of incorporation. How much risk? You are personally liable for everything done in the business’ name. You can hire employees as you would with any other business, but if they damage someone else’s property you can be personally sued for the damages. This puts everything you own at risk.

Partnership

A partnership is where two or more individuals formally agree to do business together. Partnerships are very easy to form, and the income earned from the business is filed on the individual partners’ tax returns. As with a sole proprietorship, you pay no corporate income tax and avoid double taxation.

However, as with a sole proprietorship, there are risks involved. Partners are personally legally liable for not only their actions, but the actions of all general partners. For example, if your partner takes on a business loan, you are also responsible in seeing that it is paid back.

Corporations and Limited Liability Businesses

There are several types of corporations and limited liability business structures that can be used to avoid some or all of the business’ liability undertaken with a sole proprietorship or partnership.

C Corporation

In this business structure, you pool your money together with other shareholders and are given stock in the newly formed business. A C Corporation is viewed as a completely separate tax entity in the Internal Revenue Service’s eyes, so your business can take tax deductions just as an individual would. This also means your profits will be taxed twice: once at the corporate income tax level, and then again when the corporation pays you via salary, bonuses, or dividends. Since the C Corporation is a separate entity, your personal liability is limited.

S Corporation

An S Corporation is a legal entity formed just like a C Corporation with the added bonus that income flows directly to your personal income taxes through what is called “pass through” taxation. There is no double taxation. This structure is especially nice because your liability is limited to that of a regular shareholder, but you only pay tax once.

Limited Liability Corporation (LLC)

An LLC is a state allowed business structure that mixes the benefits of sole proprietorships and corporations while removing some of the disadvantages. Owners of LLCs are referred to as members. There can be any number of members, but there is always a a managing member who is in charge of daily operations for the business. All members are not personally responsible for judgments made against the company, and taxes pass through to their personal income taxes. There is also a lot less paperwork for an LLC compared to a C corporation or S Corporation. You are also not required to have a shareholders meeting every year, nor a board of directors.

Limited Partnership

A limited partnership is an interesting twist on the partnership model. If you try to form a business as a partnership you will find it hard to raise capital due to the risks involved, with all partners being liable for one partner’s actions. A limited partnership aims to avoid this scenario by having two types of partners: general and limited. General partners are the ones involved in the day to day operations of the company, and still share all of the liability of all general partner’s actions. Limited partners are essentially passive investors, be it angel investors, venture capitalists, or friends and family, who contribute funds and are paid profits, but cannot participate in the management of the business.

Final Thoughts

When selecting a business structure, limiting your liability should be one of your first priorities. Choosing more liability for ease of set up can be dangerous. Even if you play things very safe and are confident in your future performance, there is still a chance you make a mistake along the way that could cost you your home. But time and effort involved in setting up a business structure with less liability can be costly, as well. Get specific advice from your lawyer, CPA, and the Small Business Administration before moving forward. Make the right decision the first time so you can concentrate on growing your business in the long term.

|

Business structure

|

Ownership |

Liability |

Taxes |

|

Sole proprietorship

|

One person | Unlimited personal liability | Personal tax only |

| Partnerships | Two or more people | Unlimited personal liability unless structured as a limited partnership |

Self-employment tax (except for limited partners) Personal tax |

| Limited liability company (LLC) | One or more people | Owners are not personally liable |

Self-employment tax Personal tax or corporate tax |

| Corporation – C corp | One or more people | Owners are not personally liable | Corporate tax |

| Corporation – S corp | One or more people, but no more than 100, and all must be U.S. citizens | Owners are not personally liable | Personal tax |

| Corporation – Nonprofit | One or more people | Owners are not personally liable | Tax-exempt, but corporate profits can’t be distributed |

| Limited Liability Company (LLC) | Sole Proprietorship | C Corp | S Corp | |

| Formation Requirements, Costs | Must file with state, state specific filing fee required | None | Must file with state, state specific filing fee required | Must file with state, state specific filing fee required |

| Personal Liability | Members are not typically held liable | Unlimited liability | Shareholders are not typically held liable | Shareholders are not typically held liable |

| Administrative Requirements | Relatively few requirements | Relatively few requirements | Election of board of directors/officers, annual meetings, and annual report filing requirements | Election of board of directors/officers, annual meetings, and annual report filing requirements |

| Management | Members can set up structure as they choose | Full control | Shareholders elect directors who manage business activities | Shareholders elect directors who manage business activities |

| Term | Perpetual, unless state requires fixed amount of time | Terminated when proprietor ceases doing business or upon death. | Perpetual: can extend past death or withdrawal of shareholders | Perpetual: can extend past death or withdrawal of shareholders |

| Taxation | No tax at the entity level. Income passed through to members | Entity not taxable. Sole proprietor pays taxes | Taxed at corporate rate and possible double taxation: Dividends are taxed at the individual level if distributed to shareholders | No tax at the entity level. Income passed through to the shareholders. |

| Double Taxation | No | No | Yes, taxed at corporate level and then again if distributed to shareholders in the form of dividends | No |

| Self Employment Tax | Salary subject to self employment tax | Subject to self employment tax | Salary subject to self employment tax | Salary subject to self employment tax, but shareholder distributions are not subject to employment tax |

| Pass Through Tax Treatment | Yes | Yes | No | Yes |

| Transferability of Interest | Possibly, depending on restrictions outlined in the operating agreement | No | Shares of stock are easily transferred | Yes, but must observe IRS regulations on who can own stock |

| Capital Raising | May sell interests, but subject to operating agreement (Securities laws may also apply) | Individual provides capital. | Shares of stock are sold to raise capital (Securities laws apply). | Shares of stock are sold to raise capital. Limitations prevent S corp stock ownership by corporations or foreigners |

| Ease of Operation | Easy, some states may require more than others | Easiest | Must have annual meetings, Board of Directors meetings, corporate minutes, and stockholder meetings | Must have annual meetings, Board of Directors meetings, corporate minutes, and stockholder meetings |

Still have questions ?

Incorporate Now

and enjoy our services

© 2019 Fast Inc. Usa All Rights Reserved

FAST INC LEGAL DISCLAIMER

PRIVACY POLICY

CANCELLATION/REFUND POLICY

Follow Us: